Consumers’ passion for and rapid adoption of technology presents both opportunities and risks for all businesses. As the time we spend with various screens reaches new highs (over 5.3 hours per day, eMarketer July 2013), the imperative to re-evaluate your marketing strategy and resource allocation intensifies. The largest risk is a drastic uptick in commoditization, especially if you are targeting or catering to the millennial generation. The opportunities include a social and mobile led retention strategy.

SEEDS OF EMPOWERMENT: PRE-WEB MAINSTREAM

Even before the millennial generation, the winds of change, disruption, and consumer empowerment were underway. Let’s take a look at the hospitality vertical and how empowered all consumers have become over the last 20 years. Before 1996 (the year I started business school, referred to as BBS, before business school), planning a trip could include reading magazine, travel books, using your landline phone to dial a travel agent or call a travel provider directly (if you could find the number in the phone book). We had to book by using the travel agent, calling hotel directly or calling HRN (predecessor to Hotels.com). Since we had no idea if the price being quoted as the lowest, we tried to negotiate (some baby boomers still try to do this). We would use paper maps and stop frequently to ask directions. Word of mouth was in person – not very viral.

Around 1995, everything changed when the Internet was born. Netscape went public. Bezos drove cross-county and founded Amazon. In 1996, Expedia (then part of Microsoft), Booking.com and Travelocity were founded. Hotels.com launched a website to complement their 800# service. This was the beginning of empowerment. Consumers could log on to one site and view rates from my hotels in a market, view photos and book online. E-commerce was born.

THE PC-WEB ERA

Google started the year I graduated business school, 1998 – let’s call it ABS (after business school). This period is marked by the fast adoption of search and, later, comparison-shopping. This intent based, pull marketing changed marketing forever. Businesses who adopted search marketing gained a competitive advantage. Marketing accountability was born and I started DMW (Jan 2003). Consumers loved the immediate access to information and answers to their questions. Google quickly became a verb. TripAdvisor was founded in 2000 but really hit its stride during the next phase of empowerment. Compare the ABS to the BBS period – wow, what a difference. We could make better travel decisions while saving ourselves a ton of time.

OPEN, CLOSED & MOBILE WEB

The real period of empowerment began between 2004 when Facebook was founded and 2007 when Apple released the first iPhone. Apple delighted consumers with an unbelievable user experience and ego-expressive design. TripAdvisor user reviews started to drive the choice of hotels along with rates and location. DMW began our user review optimization practice. Consumers became passionate about their smartphone – finally, an all-in-one device that was fast and really worked. The app community continued to fuel this passion by releasing great apps. Consumers were now in the driver seat. Twitter was founded in 2006. Next came the iPad in 2010. Mobile and social where building on themselves and consumers were more empowered than ever to make great travel decisions. By themselves. With their smartphone. They can share their experiences and opinions with friends and strangers. Meta-search on Kayak and recently TripAdvisor and Google further empowered users to compare hotels with real-time rates, availability, reviews, maps, etc.

Other important changes that lead to further empowerment included the growth of auctions for consumers and media buyers (Google, etc.), best rate guarantees, rate parity (or not), etc. With one click, consumers can sort results by price. All of this technology and change tilted the hotel buying process toward price, thus fueling commoditization. Disruption was all around with OTAs stealing share from each other and suppliers. Mobile apps and an intense focus on UX increased the scope (choice) advantages of the OTAs.

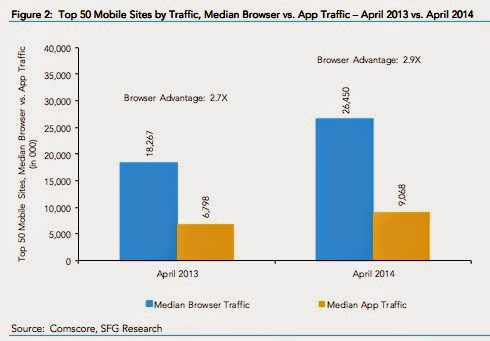

An important result of all this change is that Mobile app usage has become the new loyalty paradigm. Google is terrified of this as consumers can search their iWhatever and bring up their favorite app – bypassing Google search all together. When Google is under assault, so too is the competitive advantage that many of us established with search marketing. The "open" world of Google, browsers, and most websites (including mobile web) remain very relevant. Marketing winners, however, must continue to adapt. They must learn how to navigate the "closed" digital world, too: all iOS and Google Play Apps, as well as much of the social world (including Facebook). Understanding this “closed” universe and it’s relationship to the “open” Web is key to your next marketing strategy.

MILLENIALS

Millennials are defined as those born between 1980 and 2000, today 13 to 33 years old. Their behaviors and needs are very different from the prior generations due, at least partly, to the new paradigms of mobile and social. They have grown up with technology and are extremely comfortable with it. Recent studies suggest they are open to learning, experimentation and are great sources of innovation. According to The New York Times, “Social media permeate the personal, academic, political and professional lives of millennials, helping to foster the type of environment where innovation flourishes. So when compared with older generations, millennials learn quickly — and that’s the most important driver of innovation.” These consumers are more transparent in their communication with peers (social media) and businesses (user reviews). This is very different behavior than baby-boomers, many of which are uncomfortable with change. In fact, compared with GenX and Baby Boomers, Millennials are open to personalization through data analysis and targeting. Here are the results of an interesting study:

Unfortunately, due to these factors, Millennials also tend to be less loyal. But, they are open to trial and are a great acquisition opportunity. Just make sure your user experience is optimized - both on property and via mobile devices.

IMPLICATIONS

Here are the key implications for marketers.

- Understand your target audience. Whom do you need to reach and cater to achieve your business objectives. Does your target include Millennials? If so, adjust your market resource allocations appropriately.

- Actively listen to your current customers and optimize their ratings and reviews. This is foundational and will create marketing option value.

- Increasingly move resources from offline to online. Rapid device proliferation and the empowered consumer dictate.

- The Open and Closed web should be central to you marketing strategy. How do you win in a Web that is increasingly divided by open sites and closed app and networks?

- Don't underestimate Social media. How does social media feed your retention strategy? Acquisition strategy? Mobile strategy?

- Be willing to cannibalize yourself....before you're cannibalized by a competitor or distributor.

- Understand that customer experience is key to loyalty. Break down silos and collaborate with your peers in operations.

- Really understand your metrics. What’s your customer acquisition cost? What’s your cost to retain a customer? How do you drive increased frequency? What’s your lifetime value of different user segments?

- Use media and device attribution to measure and/or estimate return value (versus last-click measurement). Ironically, digital marketing has become harder to finitely measure. Learn to be comfortable with this and follow your customers.

Gotta wrap it up. We are happy, however, to continue this conversation with you. Please comment below or contact DMW.

By Jack Feuer -- Founder & President, Digital Marketing Works